There are several ways to analyze the future direction of energy commodities. Your goal as a trader is to determine future supply and demand using different factors that will affect how energy is consumed or produced. In addition, many traders also use technical analysis which is the study of past price movements to determine the future direction of energy commodities. By using a combination of both fundamental supply and demand analysis as well as technical analysis, you will give yourself the best gauge of the value of specific energy commodities.

Energy Commodities

The most actively traded energy commodities are petroleum-based commodities and natural gas. Petroleum consists of crude oil, heating oil and gasoline. The most actively traded crude oil locations are West Texas Intermediate (WTI) in the United States. Brent Crude oil traded in Europe. Natural gas is most actively traded in the United States but is also traded in Europe and Asia.

Supply and Demand

If you plan to engage in commodity trading its important to understand both the supply and demand of each product. US based products such as WTI and Nymex Natural gas are mainly driven by the supply and demand in the United States. These metrics can be followed using the Energy Information Administration website, which is part of the US Department of Energy.

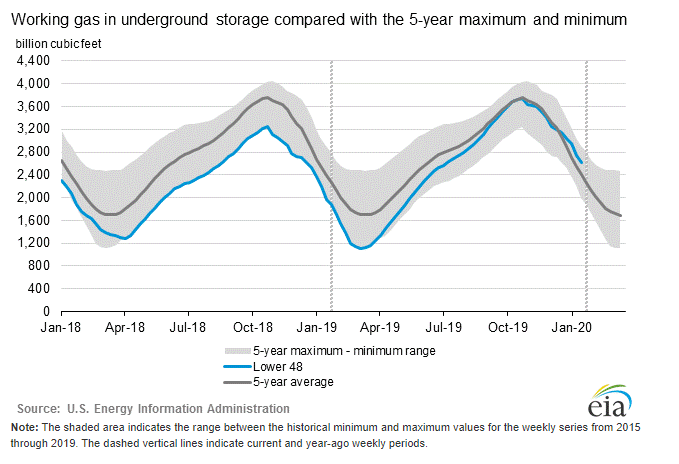

The EIA provides information on production as well as consumption. The net result on a weekly basis is the inventory levels within the United States. These levels are also affected by imports that come into the US and exports that leave the US. The Energy Information Administration on a weekly basis produces a petroleum status report and a natural gas status report. These reports are released on Wednesday and Thursday respectively unless there is a holiday during the reporting week.

For example, the weekly report on natural gas will show you the current level of inventories relative to the 5-year average range for that time of year. When inventories are on the upper end of the average range and climbing, prices may feel downward pressure. When inventory levels are at the lower end of the 5-year range prices could experience tailwinds.

The Weather and Energy

The weather can alter both supply and demand. The supply of energy can be altered by inclement weather than can disrupt production in different locations. The hurricane season in the US, runs from June to November and can produce significant storms that will alter energy supply. There is significant energy production in the Gulf of Mexico as well as Texas and Louisiana. When storms roll into the Gulf of Mexico, energy producers can evacuate their production facilities, and this will delay future supply. Storms can also block imports from making their way into the United States or exports leaving the US. A reduction in future supply might change the inventory dynamic and put upward pressure on energy commodities.

The weather can also drive demand. Warmer than normal temperatures during the summer can drive up natural gas prices. Colder than normal weather during the winter can also buoy prices. The reverse is true when the weather is warmer than normal in the winter or cooler than normal during the summer. Since petroleum is also used as a heating fuel it will also drive petroleum prices.

Technical Analysis

The future direction of energy commodities can also be predicted using technical analysis. This is the study of past price action to predict future price movements. Technical analysis can consist of support and resistance as well as trend following and momentum.

Bottom Line

The key takeaway is that there are several ways to analyze energy commodities. You want to get a gauge of supply and demand as well as how external forces such as the weather will drive prices. In addition, you can use technical analysis to evaluate the likely future direction of an energy commodity.