Being self-employed has its perks, but handling your own finances isn’t one of them. If you don’t know how to provide proof of income, click here.

It’s estimated that between now and the year 2020, 27 million Americans will ditch their full-time jobs in favor of self-employment. Although working for yourself brings plenty of freedom, handling the financial aspect of things isn’t always easy. If you need to get a loan or credit card after leaving your full-time job, you’re probably wondering: “How do I show proof of income when I am self-employed?”

The answer is simpler than you might expect. You only need to pay yourself as an employee and create your own self-employment pay stubs. Here’s a look at some of the reasons you might need to show proof of income, and the best ways to do it.

The Need to Show Proof of Income

Before a lender is willing to give you a loan, they’ll want assurance that you have the ability to pay them back. If you don’t have a steady income, you’ll have trouble getting the credit you need.

Although the self-employment revolution is here, many new businesses don’t survive their first year. This is one of the reasons lenders make business owners jump through extra hoops.

Setting up your payroll the right way will help ensure you have the necessary documentation when you need it.

Methods of Documenting Your Income

There are a few ways to show proof of income for self-employed individuals. These include:

- Annual tax returns

- Copies of bank statements

- Profit and loss reports

- Statements of income and expenses

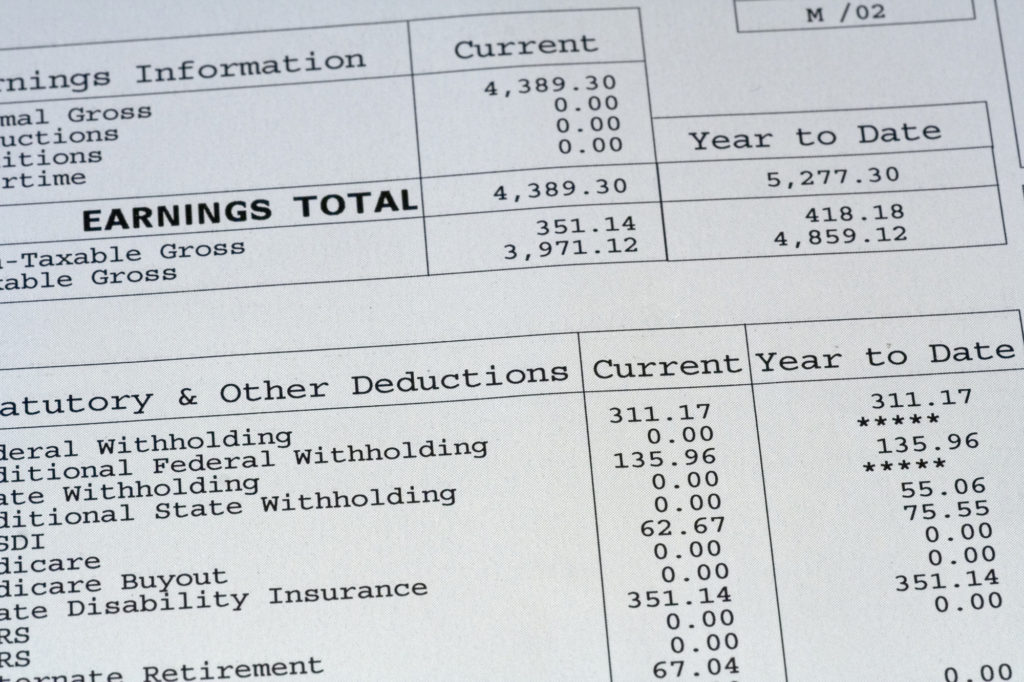

- Pay stubs and W2s

Different lenders will have different requirements. There are also pros and cons to providing each of these types of documentation.

Generating professional paystubs shows that your income is consistent. It may also allow you to avoid having to provide extra details about your business finances.

Benefits of Using a Pay Stub Generator

If you’re worried about the extra time and expense of running payroll and creating a self-employed pay stub, you’re in luck. Using an online pay stub generator is easy and the cost is minimal. Simply create a template, plug in the numbers, and the system will run the calculations for you.

The paystubs look professional enough to provide to any lender and using a program to do the calculations reduces the chances of error. Keeping your pay stubs organized makes it easy to file your taxes and find other important information when you need it.

Set Yourself Up for a Financially-Solid 2019

Now that you know how to show proof of income as a self-employed person, you’re well on your way to taking better control of your finances. Having access to credit when you need it will help you leverage your income and grow your business.

While you’re here, check out these additional tips for how to financially prepare yourself for the future. Putting them into action now will put you in the perfect position to make 2019 your best year ever.