You can’t run a successful business if you don’t keep your books in order. Unfortunately, not everyone does this.

If you don’t know how much money your company has, how can you plan for the future? When 82% of businesses fail because of poor cash flow management, you don’t want to put yourself in this situation.

Are you worried that you aren’t taking as much care of your financial books as you should be? Follow the five business bookkeeping tips below to get back on track.

1. Keep Your Business and Personal Finances Separate

Mixing personal and business finances is a common mistake people mistake when starting their business. But doing this creates nothing but headaches when you try to get your books in order.

Make sure to create a separate bank account for your business. Make all your business transactions using this account. Doing this will stop you from mistaking personal income and expenses for business transactions.

2. Automate Everything You Can

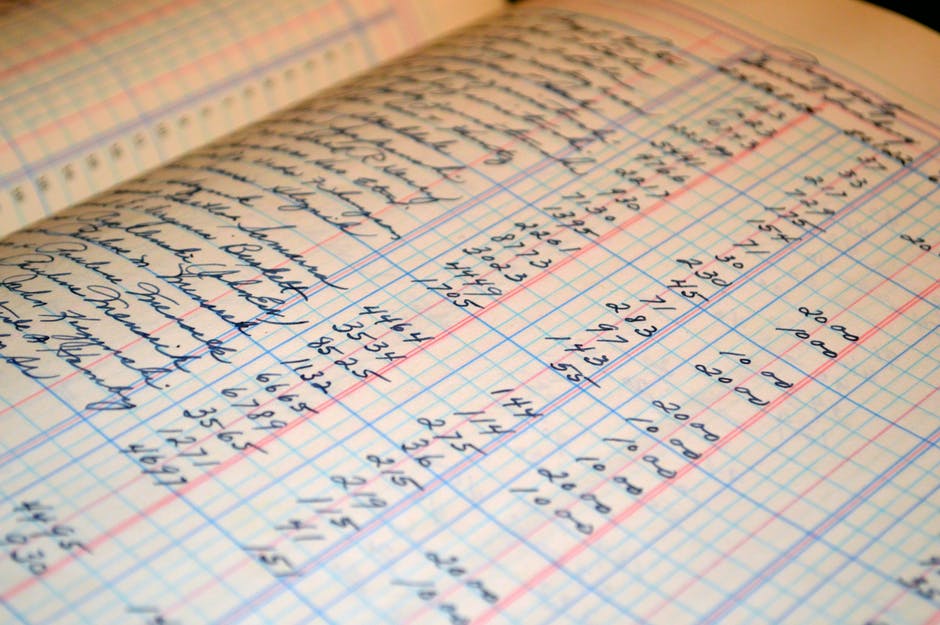

It takes enough time to do your books as is. If you’re manually recording your income and expenses on spreadsheets, you’re doing things the hard way.

You have online bookkeeping software that takes a lot of the work away from you. This software can connect directly to your accounts to import and categorize every transaction in your business. There’s no need to keep track of everything by hand anymore.

3. Do Regular Reviews

If you don’t like finances, it might be tempting to put off reviewing your books. Make sure you don’t fall into this trap.

You don’t need to review your books every day, but you should take the time to do it weekly or monthly. Doing this will allow you to get an up to date overview of your business. Look for any weird transactions or outstanding invoices you need to follow up on.

4. Watch Your Tax Deadlines

When you do your personal taxes, you’re only filing once per year. Things change when you own a business.

Businesses need to file their taxes quarterly. Your payment is based on your estimated income. Make sure you keep track of your quarterly deadlines so you can make your estimated payments.

If you wait until the end of the year, you could face penalties from the IRS.

5. Hire an Accounting Expert

While it doesn’t take too much time to do your books once you get a system going, it does still require effort to keep up. If finances aren’t your thing, you’re probably better off working on other parts of your business.

Look into accounting companies to do your books for you. Once you learn more about how they can help, hiring an expert will start to make more sense.

Don’t Get Your Business Bookkeeping Wrong

The last thing you need is not to know how much money your business has available. If you don’t get your business bookkeeping right, then you run the risk of this happening. Follow the tips above to get your books in order.

Once you get your books in order, you can start to manage your finances to improve your bottom line. Head to our finance section for tips that can help.