You’re never too young or old to budget—it’s just that as you move through your life, your priorities, income and expenses will change.

Most younger consumers are thinking about things like how to afford an education, paying rent, going out with friends, traveling and perhaps buying a vehicle. As people get a little older, they start to think about buying homes, having children, climbing the career ladder, pursuing new hobbies, pursuing post-secondary education and upgrading certain aspects of their lives. Then there’s pre-retirement, in which people are thinking about hitting savings goals, spending time with their families and setting themselves up for the day they stop working.

Of course, your exact goals and lifestyle choices will depend on you as an individual. But whatever you decide to do, building a solid financial foundation will help you get there.

Of course, your exact goals and lifestyle choices will depend on you as an individual. But whatever you decide to do, building a solid financial foundation will help you get there.

Here are a few clever budgeting tips customizable for any stage of life.

Understand Fixed vs. Variable Expenses

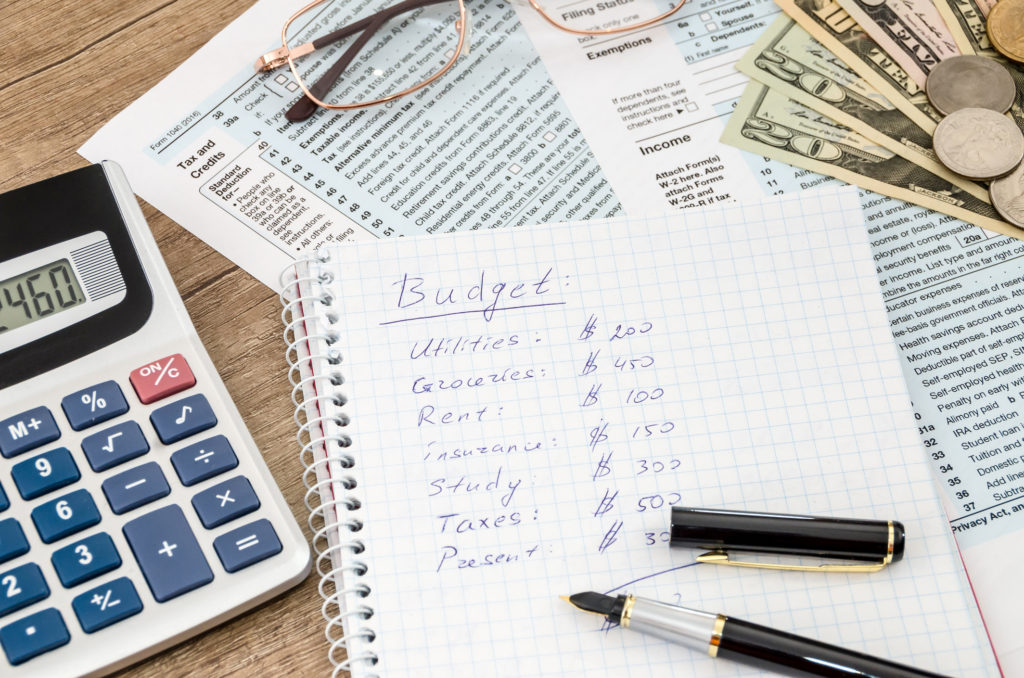

As sure as the sun will rise again, you’ll have expenses to cover at every age. And the first step in budgeting is always understanding where your money’s going each month.

Some of these expenses will recur—like your rent/mortgage, your auto loan payment, groceries, subscriptions, etc. Others will be variable, meaning they’ll go up and down depending on the circumstances. Perhaps one month you spend $500 on traveling but the next three months you spend none; this fluctuation makes travel a variable expense, but one you must figure out how to track nonetheless.

Come up with a base number for your fixed expenses. Then build in a cushion for categories that are variable based on past experience and estimations. This way, you’ll develop a solid understanding of how much you must pay for recurring basics and what your range is for variable expenses.

Try a Money Management App

One thing people throughout generations have in common is that they’re busy. It can be tricky to set aside time to sit down and budget manually, plus it’s often tempting to put this task off “until tomorrow.” Anything that can simplify this process is a welcome development, right?

Mobile apps like Clarity Money are helping users of all ages figure out how to manage money and save in the most convenient way possible. When you can glance at your personal finance big picture anytime using your phone, you stay more in tune with where you stand. This app can also help you cancel unwanted subscriptions, saving you money you may not have even known you were spending each month.

Use Old-School Envelope Budgeting

Some people feel that money becomes more “real” to them if they handle it in the form of cold, hard cash. If this sounds like you, you may want to supplement your electronic budgeting efforts with envelopes of cash earmarked for certain expenses.

How you label your envelopes will depend on your spending habits. Here are a few example categories from The Balance: groceries, rent, transportation, utilities, personal care/clothing and savings. And once an envelope has run out for the bi-weekly or monthly period, your spending in this category stops until you get paid again.

Set Aside Money for Retirement

Whether you just got your first entry-level job offer or you’ve been part of the workforce for 40 years, saving enough for retirement is crucial. Starting sooner gives the interest your contributions accrue more time to earn interest in what’s known as compounding, so saving earlier in life has a huge payoff you’ll reap when retirement rolls around.

You can make these budgeting tips work for any stage of life. The key is understanding your needs and goals, then making your money work for them.